real estate tax shelter example

What are examples of tax shelters. Streamlined Document Workflows for Any Industry.

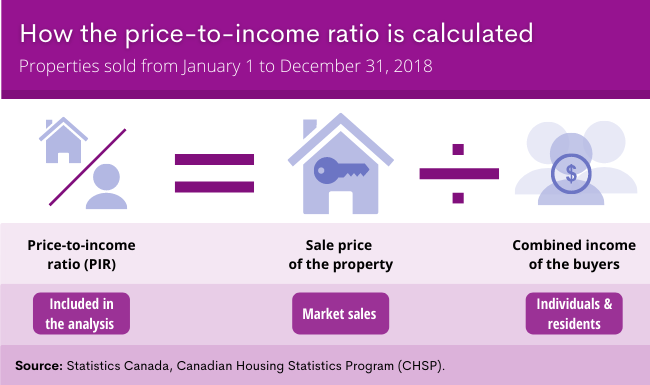

Residential Real Estate Sales In 2018 The Relationship Between House Prices And Incomes

If you earn 20000 annually for example and utilize tax shelters worth 5000 your taxable income reduces to 15000.

. It is true if you plan to use deductions as a tax shelter. Examples include fixing leaks painting and replacing broken parts of the rental property. Ee the current RET rates across the country.

Qualified retirement accounts certain insurance products partnerships municipal bonds and real estate investments are all examples of potential tax shelters. The numbers listed below are annual. Jim Harbaugh head coach of the University of Michigan football team is a prime example of someone who leveraged workplace benefits as a tax shelter Murray says.

Using Deductions as a Tax Shelter. A traditional individual retirement account IRA is another example of a tax shelter and works in nearly the same way as a 401k account. 11738 Shelter Island NY.

To see how a real estate tax shelter works lets go through an example using a 250000 property that generates 2000mo in revenue. The 421-a tax exemption. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another.

St ates counties or municipalities can impose RETs. A Real property owned by a not-for-profit corporation organized pursuant to the not-for-profit corporation law and the provisions of article two of the private housing finance law used exclusively to provide housing and auxiliary facilities for faculty members students employees nurses interns resident physicians researchers and other personnel and their. For the 2020 tax year you were able to contribute up to 6000.

According to Im Anthony Martin the CEO and founder of Choice Mutual since investing in real estate helps you save money on your taxes through various deductions its a form of tax shelter. WHAT IS A REAL ESTATE TAX. Sometimes in order to save money you must spend money.

Although there are a few legal ways to minimize your taxes sheltering is one of the easiest methods to use by making for example pre-tax contributions to tax shelters reducing your taxable income and thereby reducing your tax liabilities. Find Forms for Your Industry in Minutes. In Manhattan for example the increased value attributable to new construction for the fiscal year 197677 is only 23390 million covering.

11787 631 324-2770 631 360-7610 Huntington Town Receiver of Taxes Southampton Town Receiver of Taxes 100 Main Street. Historically real estate has proved to be a significant tax shelter. What is a tax shelter IRS.

To meet the wage requirement the developer must pay an average hourly wage of 45 for projects in Brooklyn and Queens and 60 for Manhattan projects. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. So the investor has 5000 spendable cash in his or her pocket.

For these large projects the value of the tax. Qualified retirement accounts certain insurance products partnerships municipal bonds and real estate investments are all examples of potential tax shelters. RETs can include exemptions for certain types of buyers based on buying status or income level.

Assuming this partnership has a standard no-frills operating agreement 75 of the profits andor losses will be allocated to limited entrepreneurs according to the definition above. Set Up a Retirement Account. These hourly wages are set to automatically increase every three years at a rate of 3.

A tax shelter is among other things any investment that has a tax shelter ratio exceeding 2 to 1. Ad State-specific Legal Forms Form Packages for Investing Services. A 401k or other type of tax-deferred retirement account like an IRA allows you to save money on taxes now by deferring to pay taxes in retirement when your income and tax bracket are likely lower.

Here are nine of the best tax shelters you can use to reduce your tax burden. Thus if we consider a routine example of a real estate partnership with four partners and only one of those partners manages day-to-day operations an issue immediately arises. Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges.

11964 631 451-9009 631 749-3338 East Hampton Town Receiver of Taxes Smithtown Town Receiver of Taxes 300 Pantigo Place 99 West Main Street East Hampton NY. The tax shelter ratio is the aggregate amount of deductions to the amount invested. A tax shelter is any legal strategy you employ to reduce the amount of income taxes you owe.

The courts attack such sheltered transactions using the sham transaction doctrine discussed on this website or by disregarding the form the transaction takes to determine the.

Diy Or Hiring A Property Manager Which Is Better Property Management Real Estate Quotes Management

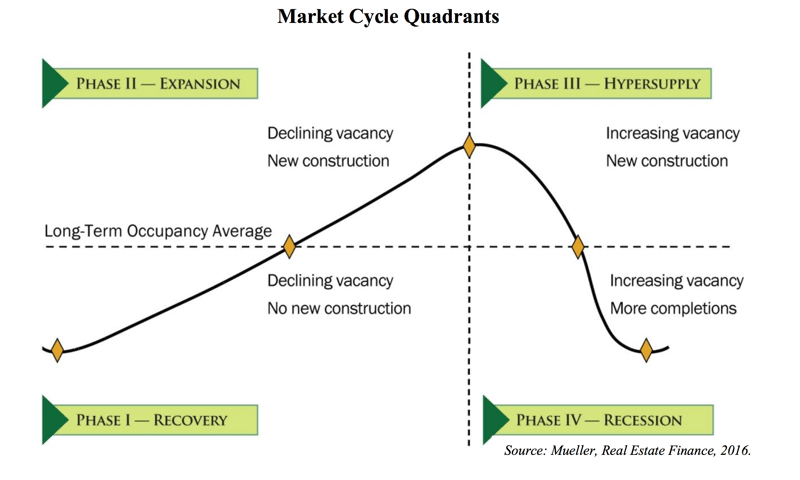

The Four Phases Of The Real Estate Cycle Crowdstreet

Principal Residence Exemption Requirements An Overview

The Benefits Of Owning International Real Estate

Five I D E A L Benefits Of Real Estate Investing Coach Carson

Sample Printable Assignment Joint Ownership With Right Of Survivorship Form Real Estate Forms Legal Forms Free Lettering

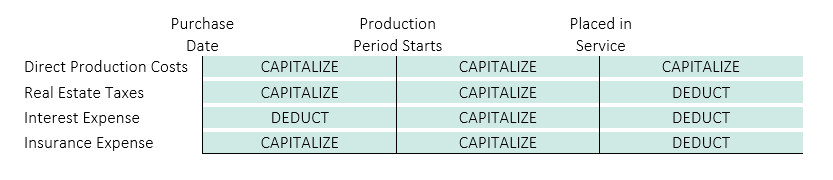

Real Estate Development When To Expense Vs Capitalize Costs Withum

Fresh Cell Phone Reimbursement Policy Template

How To Pay Less Tax When You Sell Your Cottage Mawer

How Is A Tax Shelter Calculated In Real Estate

How To Decide If A Property Is A Good Investment The Washington Post

Five I D E A L Benefits Of Real Estate Investing Coach Carson

Top Tax Deductions For Second Home Owners

15 Best Real Estate Stocks In Canada 2022 Be A Lazy Landlord

Real Estate A Safer Investment Option Post Covid Assetz

Explore Our Sample Of Real Estate Deposit Receipt Template Receipt Template Receipt Free Receipt Template

:max_bytes(150000):strip_icc()/mortgage-real-estate-investing-guide-4222543-v1-b49c49405ee14779adb25d2879411414.png)